The total value of art collections on the earth, including paintings, antiques, cultural relics, jade, stones, and so on, is greater than or equal to the total assets of real estate on the earth, about RMB 1,500 trillion.

(" Art War "articles and works push cooperation, long-term cooperation 50% discount, 30% discount for annual cooperation. Cooperative contact (WeChat ID:330300000).

The total value of art on the earth is RMB 1,500 trillion, and the world's largest collection family owns RMB 500 billion.

Art collection, in addition to burning money to brush the sense of existence, but also can obtain high times windfall returns, appreciation of a hundred times is common, appreciation of tens of thousands of times is not difficult.

In 2007, David Rockefeller sold his collection of Rosko's 'White Center (Yellow, Pink, and Lavender on Rose),' painted in 1950, for $500 million at Sotheby's in New York. When David Rockefeller bought the Rothko for $70,000, it appreciated 7, 000 times.

Rockefeller II bought 1,500 pieces of famous Chinese porcelain from Morgan, one of the world's greatest collectors, for $1 million after his death. Now this batch of porcelain, any piece can be sold for RMB tens of millions.

In 2013, there was a dramatic return of a kind of "Democratic Leikind" of national treasures, which was once part of the Rockefeller family's collection and was worth tens of millions of dollars.

(David Rockefeller sold Rothko's "White Cent" for $500 million, which cost $70, 000 to buy and appreciated 7,000 times.)

The total value of art on the earth is RMB 1,500 trillion.

Who controls the pricing power of the art collection?

What is the asset size of the art collection on the planet? This is a devil's law: the total scale of the assets of the art collection on the earth, including paintings and calligraphy, antiques, cultural relics, jade, stones, and so on, is greater than or equal to the total scale of the real estate assets on the earth, about 1,500 trillion.

Why is there such a devil's law? Evaluated in terms of money, the spiritual wealth created by human beings in history should be equal to the material wealth created by human beings. The spiritual wealth of human beings is mainly reflected in the luxury collection of art, while the material wealth of human beings is mainly reflected in the real estate. How to prove this devil's law, that is usually a controversial agendum.

However, the global high-end art market is basically monopolized by European and American luxury conglomerates and Western wealth inheritance families, who also have the circulation channels and pricing power of high-end art collections.

Although the world has a huge amount of art collection assets, but the lack of circulation channels for art collections, a large number of art collections are precipitated as dead assets and cannot be circulated.

Once the massive art collection assets of trillions are activated, they are counted into corporate capital or injected into listed companies. Undoubtedly, countless collectors of painting and calligraphy, antiques, literary games, jade, stone, and so on will become rich.

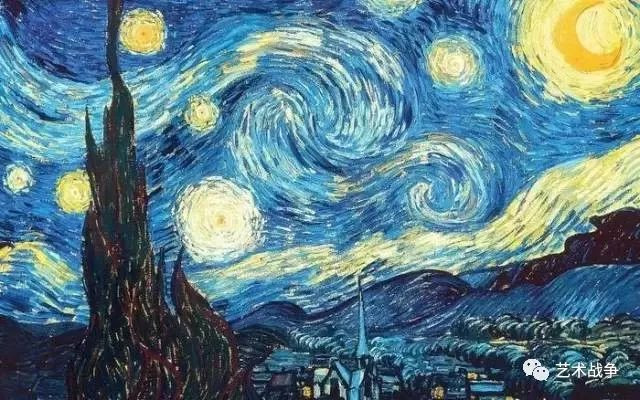

(Van Gogh's Starry Night, $1 billion from the Rockefeller family collection)

Art Collections Market

The rich get richer and the poor get poorer.

The price of the works of art masters is getting higher and higher, but the price of the works of ordinary painting and calligraphy artists is getting lower and lower.

In the global market for art collectibles, the rich are getting richer and the poor are getting poorer. Because the circulation channels and pricing power of artworks are monopolized.

Ordinary painting and calligraphy artists, even if you are a genius of painting and calligraphy, lack circulation channels and pricing power. Thousands of paintings in your home are rubbish. Even if you want to give them away, no one may want them.

The largest art dealer in the world is Christie's, whose annual turnover is estimated at around RMB 40 billion, almost as much as all the art auction houses in China combined.

Christie's is controlled by Francois Pinault, who is also the controlling shareholder of Gucci Group, the luxury goods group, and Printemps, the luxury sales giant.

Francois Pinault, 82 years old, is also one of the world's leading art collectors. Collection includes works of Picasso, Miro, Mondrian, Andy Warhol, Jeff Koons and Damien Hirst. Pinault's collection covers almost all the major modern and contemporary art genres in Europe and the United States.

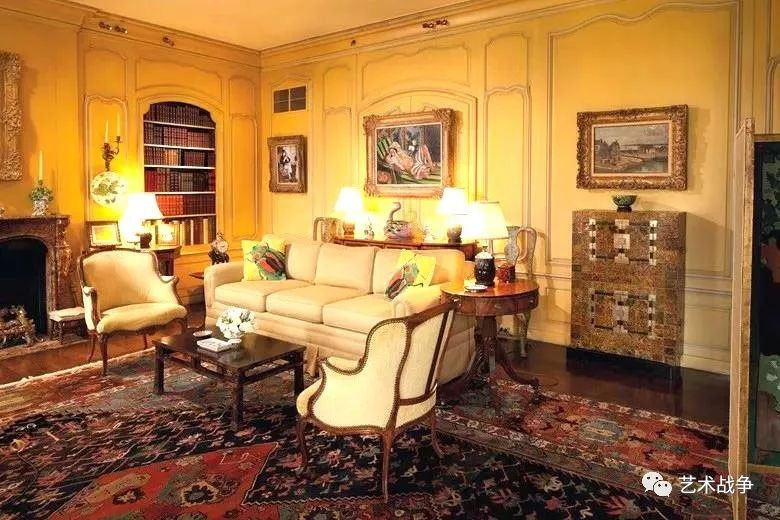

(Picasso's "Girl with a Flower Basket," sold for RMB 732 million, had been placed in the study of David Rockefeller's 65th Street mansion in New York)

Who has monopolized the art market?

European and American Luxury Goods Syndicate

Western wealth is passed on to families.

The price of art works is closely related to the price of luxury goods, and art works are special luxuries.

European and American luxury consortia take advantage of their dominant power in the art market to control the pricing power in the art market to protect the monopoly interests of European and American luxury consortia families.

The main body of western art capital is some European and American luxury consortia and western wealth inheritance families. The purpose of western art capital is to protect the monopoly interests of luxury consortiums in Europe and America.

European and American luxury consortium and Western wealth inheritance families are keen on raising the price of artworks. By controlling the pricing power of art, the artworks become a kind of currency. Finally, the wealth of European and American luxury consortium and Western wealth inheritance families with a large number of artworks can soar.

For example, after the price of Leonardo Da Vinci's "Salvator Mundi" is raised to 3 billion, the price of not only European and American classical art related to it will skyrocket, but also the price of all European and American art works will skyrocket. The price of art works and luxury goods will also be continuously pushed up, and the wealth of European and American luxury confederation and Western wealth inheritance family tycoons will be rolling in.

Compared with the price of art and luxury goods, the labor value of the vast number of manual and intellectual workers shrinks. Whether you are a manual laborer or an intellectual laborer, you toil all your life and cannot afford a single piece of art or luxury.

(Monet's "Blooming Water Lilies", 539 million, created the highest transaction price record of Monet's works. The work hung between the steps of the Pine Grove mansion in the Hudson.)

The Rockefeller family's collection of 170,000 works of art has influenced the history of 20th century world art.

The Rockefeller family, a household name, is a very tasteful art collection family, art collection volume is rich, up to 100 billion level.

The Rockefeller family has collected 170,000 pieces of various artworks for 6 generations. The Rockefeller family's art collection covers the world from ancient times to the present, from east to west, with a large number of artworks and high quality works.

The Rockefellers established MoMA in New York and donated large collections and funds to other major museums. The Rockefellers' art donations and collections have influenced the history of world art in the 20th century.

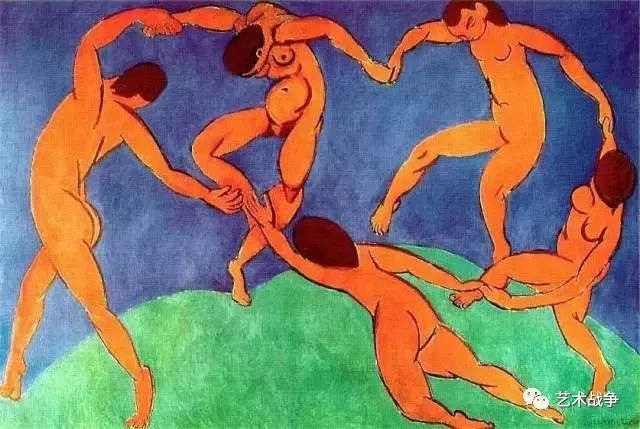

Rockefeller family collection of some of the most famous world art history of the masters of the world, including: Picasso's "the farmer's girl", van gogh's "star", "eternal memories" of Dali, monet's "water lily", Matisse "dance", mondrian's Broadway, jazz, Cezanne "bathers" and so on.

(Matisse's "Menus and Magnolia Lying on the Side" sold for 514 million, setting a record for the highest price paid for one of Matisse’s work. The painting originally hung in the living room of the Rockefeller family's Pinewood mansion on the Hudson.)

Just 1% of the art works and sell $5 billion.

The world's first collection family collection of 500 billion.

In 2018, the Rockefellers' collection was auctioned off with 1,600 works of art, bringing in 5 billion.

Among them "the nineteenth and twentieth century art", the special master of art, Picasso, Matisse, Monet, Georges Seurat, Paul Sinec, Manet, Gauguin, Corot 44 fine works of world art masters, such as full all artwork clinch a deal, clinch a deal amount is $648 million, equivalent to RMB 4.13 billion. The average work of art is close to RB 100 million.

The Rockefellers' collection of auction works is only a small fraction of the art collection of the Rockefellers, who have collected 170,000 pieces of various works of art for six generations, with an art collection volume of hundreds of billions.

Take 1% of the art collection and sell it for 5 billion. How much do you think the Rockefeller family's art collection is worth? As the world's largest collecting family, the Rockefellers have a collection of about 500 billion.

The Rockefellers are well - deserved as the world's largest art collection.

(Picasso's "Girl with a Flower Basket," sold for 732 million, had been placed in the study of David Rockefeller's 65th Street mansion in New York)

Can't afford the estate tax.

Collection the art works of the collector after their death

Auction or donation

In some European and American countries, inheritance tax is as high as 50%, and art is also a kind of heritage. So when European and American collectors die, their works are either donated or auctioned off, because the heirs can't afford the sky-high inheritance taxes.

For example, the Rockefellers' 1,600 works of art, valued at 5 billion, would have cost the heirs 2.5 billion in estate taxes if they had not sold them.

If it is inherited as an estate before auction, the one who inherits will go bankrupt. No one dares to inherit the heritage of the works of art. The only option is to turn the works of art into money after auction and then inherit as an estate.

Inheritance taxes of up to 50% force the very rich collectors to donate large amounts of art after they die, either to various museums and galleries, or to non-profit organizations and charitable organizations, which eventually return part of the wealth of the rich to society.

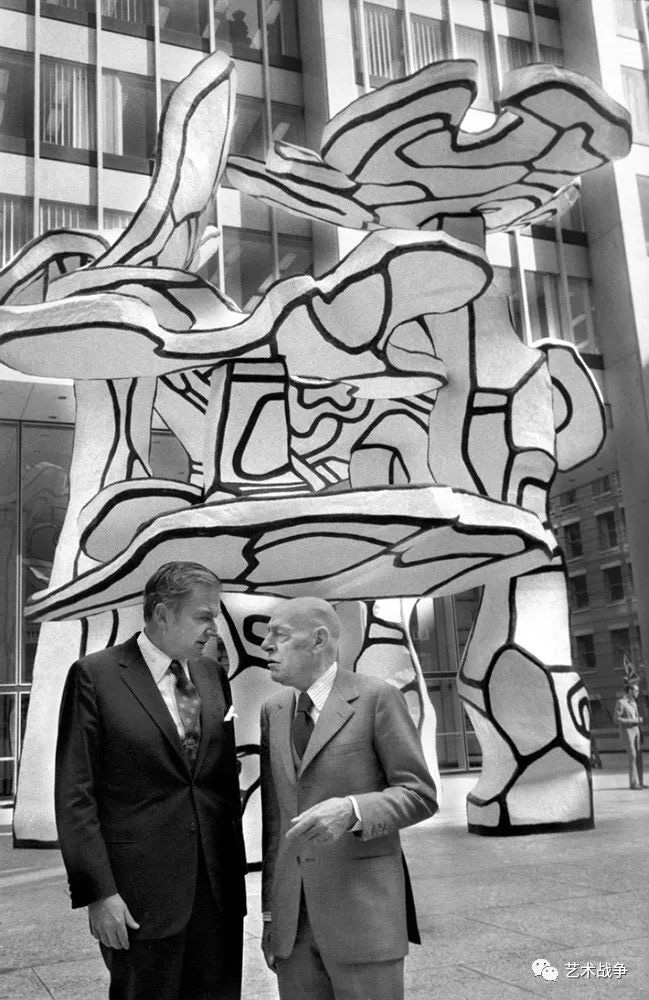

(David Rockefeller stands outside MoMA with French sculptor Jean Dubuffet with a piece of Dubuffet's sculpture behind him)

Private museums, art galleries

Tool to avoid the estate tax

MOMA, Museum of Modern Art, New York

There are 170,000 pieces of art collected by the Rockefeller family over six generations. If passed down as inheritance, after several generations, the Rockefeller family may have to pay the astronomical estate tax of hundreds of billions.

One of the best ways for wealthy art collecting families in Europe and the US to avoid sky-high inheritance taxes is to donate most of their art to family-controlled museums and galleries.

Of course, a small number of works of art still have to be auctioned, and the most important thing is to realize. A few take out to auction, can lift artwork market ceaselessly high. But not too many can be auctioned off, or the market for art collection will be washed away by the death of the head of several very rich collecting families. After all, manipulating prices in the art market is a core interest of the wealthy art collecting families in Europe and the US.

Museums and galleries are the best tools to avoid the inheritance tax on expensive works of art. They are also the best tools to manipulate the price of the art market.

New York's Museum of Modern Art (MoMA) was founded and controlled by the Rockefellers to receive their billion-dollar artistic legacy. The Museum of Modern Art in New York is one of the most important modern and contemporary art museums in the world, alongside the Tate Gallery in London and the Pompidou Center for Culture and Art in France.

(The Museum of Modern Art (MoMA) in New York, behind the wall is the representative work of Picasso "La Dame de Avignon," worth more than a billion.)

Declining of Rockefellers

Rising out of the second industrial revolution

Fallen in the Third Industrial Revolution

The Rockefellers were the fathers of the trust. At one time, the Rockefellers controlled 90% of the oil refining industry in the United States. They refined 95% of the oil produced in the United States.

The Rockefellers were born in the "electrical age" of the second industrial revolution, because the Rockefellers had a monopoly on oil, the core energy of the "electrical age". The Rockefellers had as much wealth as the world's top 10 richest people combined.

The Rockefeller family declined rapidly in the "IT industrial era" of the third industrial revolution. Now the Rockefeller family has about 200 people, and the total wealth is about 10 billion US dollars, ranking about 20 among the old inheritance families of super-rich in Europe and America. David Rockefeller, the late head of the Rockefeller family, had an estimated fortune of USD 3 billion.

The Rockefellers, in rapid decline, can only rely on a collection of 170,000 art pieces to demonstrate their past wealth and glory.

(In 2018, the Rockefellers' collection sold 1,600 works of art for 5 billion.)

White Capital and Black Capital

Monopolistic interests of luxury consortia

Capital itself is neutral, but capital is a huge weapon. Capital, the weapon in the hands of different people, the property of capital will change into different properties. The use of capital determines that capital is not neutral.

There are also black and white capital. The two most influential kinds of capital in the world today are white capital and black capital.

White capital promotes social progress and scientific and technological innovation. The main body of white capital comes from the newly rich families rising in the "IT industrial era" of the third industrial revolution. For example, technology capital is the most influential white capital in the world today. Driven by science and technology capital, the public can enjoy the most advanced technology and services at the lowest cost.

Black capital resists social progress to protect the monopoly interests of vested interests. For example, the European and American luxury consortia and the western art capital are the most influential black capital in the world today. Their purpose is to protect the monopoly interests of the European and American luxury consortia. The main body of black capital is the inheritance family of the old super-rich in Europe and America, and the wealth mainly accumulated in the "Electrical Age" of the second industrial revolution.

The main body of western art capital is some luxury consortia in Europe and America. The purpose of western art capital is to protect the monopoly interests of luxury consortiums in Europe and America. Dominant European and American art market, it is these European and American art capital with black capital color.

(Matisse's "Menus and Magnolia Lying on the Side" sold for 514 million, setting a record for the highest price paid for one of Matisse’s work. The painting originally hung in the living room of the Rockefeller family's Pinewood mansion on the Hudson.)

Market manipulation by the art collection family.

fight for art pricing power

The price of art works is closely related to the price of luxury goods, and art works are special luxuries.

European and American luxury consortia take advantage of their dominant power in the art market to control the pricing power in the art market to protect the monopoly interests of European and American luxury consortia families.

Rich people of European and American luxury confederation are keen on raising the price of artwork. By controlling the pricing power of art, the artwork becomes a kind of currency. Finally, the wealth of rich people of European and American luxury confederation with a large number of artworks can soar.

For example, after the price of Leonardo da Vinci's "Salvator Mundi" is raised to 3 billion, the price of not only European and American classical art related to it will skyrocket, but also the price of all European and American art works will skyrocket. Compared with the price of art, the value of the labor of the masses diminishes.

Do you have any idea how large the art-like monetary assets on the planet are? It's in the tens of trillions of dollars, and if you divide it evenly among the seven billion people on the planet, each of the seven billion people on the planet would have a million dollars.

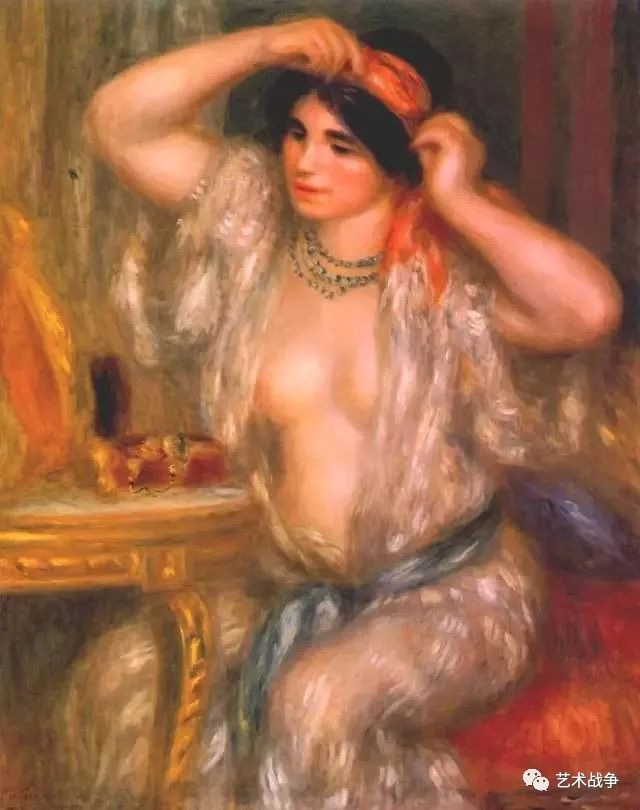

(Renoir's Gabrielle at the Mirror, worth hundreds of millions, from the Rockefeller family's collection)

A Chinese apprentice to the Rockefeller family

The godfathers of Chinese art collection Sigg and Ullens

The largest collector of Chinese modern and contemporary art is Sigg, with a collection of 2200 pieces. Sigg has mysterious capital backing behind him, and his manipulation of the Chinese art market is inscrutable.

Sigg successfully controlled M+ Visual Art Museum in Hong Kong by making a huge exchange deal with it. Sigg successfully influenced the art ideology of Hong Kong in the coming decades. Sigg's thousands of pieces of Chinese art are worth billions of RMB.

Ullens is also a successful collector of modern Chinese art, with more than 1,700 works of Chinese art, including more than 1,300 works of contemporary Chinese art. Ullens went directly to China to build an art museum to control the price of Chinese contemporary art. The value of Chinese art in Ullens' hands is estimated to be over RMB ten billion. Ullens duly cashed in on the auction market and sold his art back to China.

In the past 20 years, European and American art capitals have bought a large number of Chinese oil paintings at the price of Chinese vegetables. They have raised the price of some Chinese oil paintings by hundreds or thousands of times. The purpose of European and American art capitals is to wait for Chinese collectors to pay hundreds or thousands of times the price to buy back the sky-high price of Chinese oil paintings.

(Dali's "The Persistence of Memory," from the Rockefeller family collection, is worth hundreds of millions)

Fiasco lessons from the Japanese art collectors

Bought the European and American sky - high price art bubble

During Japan's bubble economy in the 1980s and 1990s, the price of land in Tokyo would have bought the entire United States plus the market capitalization of all publicly traded companies in the United States. Japanese companies continue to pay huge sums at auction for early Impressionist works in European and American modern art that are 100 years out of date.

After the bursting of Japan's economic bubble, the sky-high prices of European and American art produced by this batch of Japanese enterprises were sold at low prices. Among them, the unsold works still kept in Japanese banks were worth $5 billion in that year, but now the most optimistic estimate is only worth $1.4 billion. Some Japanese enterprises that made sky-high prices in those years have gone bankrupt.

In the 1980s and 1990s, contemporary art emerged. If Japan had bought contemporary art in the 1980s and 1990s, it would have appreciated hundreds of times. However, Japan bought the early Impressionist works of modern art which were more than 100 years out of date. The backward cognition of art made Japan pay a heavy price.

Remember the lesson of Japan's bubble years, when Japanese companies went on a buying spree of outdated and expensive art from the US and Europe.

(Matisse's "Dance" from the Rockefeller family collection, worth hundreds of millions)

The art bubble market

Cultural inferiority complex

Rockefeller couple collection global auction tour in Hong Kong after the station, and temporarily increased the Beijing station and Shanghai station tour, is apparently blunt Chinese collectors silly money.

Some overnight nouveau riches buy outdated and outdated works of art from Europe and the United States with high prices, which is a lack of cultural confidence and cultural inferiority mentality.

Japan was a lack of cultural confidence in the nouveau riche cultural inferiority mentality, the lesson of Japan is to buy Europe and the United States 100 years of outdated Impressionism and huge losses.

In recent years, European and American art capitals have systematically inflated the prices of Chinese artworks and cultural relics and sold them to China's nouveau riche at sky-high prices. The ultimate goal of European and American art capital is to dump the outdated and expensive works of art into China. Some companies and collectors spend huge sums of money buying outdated and expensive works of art in Europe and the United States, which is exactly what the European and American art capital wants.